Graphene stock - an investment possibility

There are many interesting possibilities for investment and one of them is graphene stock. Graphene as such is a new super-material based on carbon. It consists of a single, one atom-thick layer of carbon atoms in a hexagonal arrangement (like benzene rings).

Its properties range from extreme durability, flexibility, and conductivity to transparency and biocompatibility.

So the question is, does it make sense to invest in graphene?

The bullish outlook

It is hard not to be bullish when considering graphene’s outlook. It is deemed to attract more speculative investors who will expect it to rise by its very nature, and stocks in companies that fully commercialize graphene’s extraordinary properties are likely to increase in value by orders of magnitude.

Hurdles along the way?

Of course, there are hurdles along the way. Graphene products are mostly in R&D/lab stages and correctly assessing the potential for commercialization, feasibility, as well as realistic applicability can be a challenge. That there have been not-so-good developments is true.

Can it be an issue of timing?

Investors are keenly aware of stories like IBM and APPLE and wish to capitalize on the same kind of rapid growth.

The truth is that it is still very early in the process of graphene commercialization (production process was discovered in 2004). The companies that are active in the field are likely still testing applications and penetrating new markets.

So the potential for enormous returns is there, however so are the risks.

-

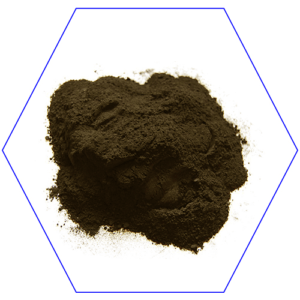

Graphene oxide

69 € – 17,744 € Select options -

CVD graphene on customers substrate

15 € – 28 € Select options -

Graphene powder

Read more -

CVD graphene film on a silicon substrate with flint oxide

37 € – 519 € Select options -

CVD graphene on PET film 100um

37 € – 519 € Select options -

CVD graphene film on a 2mm quartz substrate

37 € – 519 € Select options -

CVD graphene film on copper substrate

19 € – 1,377 € Select options -

Graphene paste

13 € – 152 € Select options

Graphene stock - what are the possibilities right now?

Essentially, the investor may consider two approaches to investing into graphene stocks – either into solely graphene-oriented companies or into companies with a more diverse portfolio of activities that contains graphene as well as others.

Is there a way to mitigating the risks?

Of course, the risk undertaken depends on risk propensity of the investor. In general, however, there are two approaches to neutralizing the risks connected to graphene investments.

A risky component of the portfolio

An investment into a promising company oriented solely on graphene may be chosen as a smaller part of the portfolio. The logic is to not risk so much, and at the same time keep potential high returns under control.

A good company is still a good company

A play on graphene can be combined with a low-risk investment into a large, stable company. In their published reports, big players like Tesla or Samsung had mentioned looking into graphene technology. Even if the particular graphene project doesn’t pan out, owning shares of a blue chip company is good one way or another.

Wait and see

While graphene’s properties are nothing short of miraculous, the material science breakthroughs are somewhat frequent; and it’s possible to earn on others as well. For graphene, it is important that it opens a path from the current silicon-based status quo into new and uncharted lands.

At the R&D stage of graphene’s commercialization, picking out the proper shares of the right traded company may be a challenge. It is also possible to provide venture capital for a graphene-related start-up. This step, however, carries the risk of high production costs and uncertain demand. Of course, it depends on the investor’s point of view – these are the risks naturally connected with a prospective, potentially high-profit environment.

The more risk-averse investors may wait and see which companies push through; and choose to invest at a later stage.